You could be overpaying by thousands and not even know it. The quickest way to find out is to do a FREE Tariff audit on your products right away!

Doing in-depth research of your products and interpreting the US HTS system the right way could save you thousands of dollars instantly!

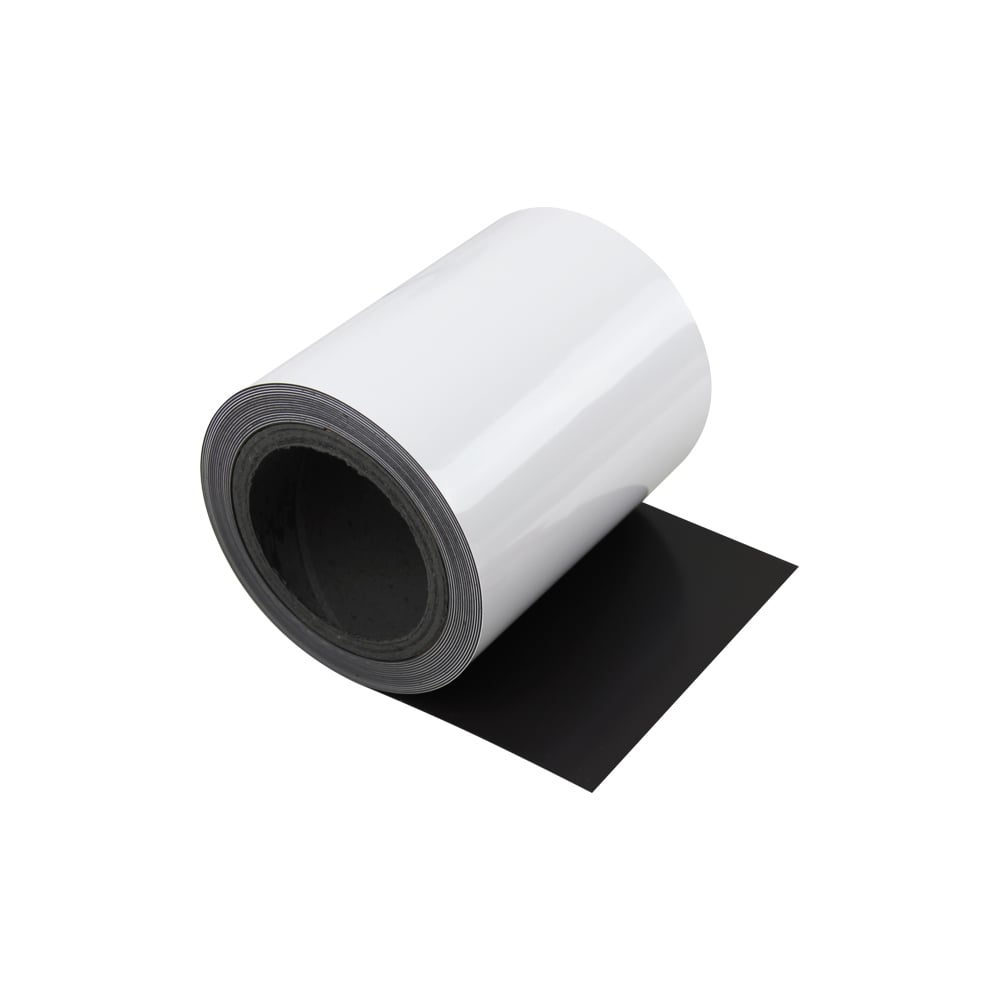

Duty Rate Before Reclassification

Duty Rate After Reclassification

Duty Rate Before Reclassification

Duty Rate After Reclassification

“When I first shipped my products into the US, I paid insane amounts of money in tariff charges, and after using the tariff terminator, I saved thousands of dollars!”

“Honu Worldwide has been an absolute game-changer for our importing business. Their Tariff Terminator service helped us eliminate tariff overspend and significantly boost our profit margins. Their expertise and fast response have saved us a substantial amount of money by providing us with better, (legal) HTS codes. ”

Tariff Terminator is a service that helps e-commerce sellers analyze and optimize their tariffs by finding the most cost-effective Harmonized Tariff Schedule (HTS) codes for their products.

Our experts analyze your current tariffs, sift through US Tariff database to identify the lowest tariff codes applicable to your product so you can pay the lowest tariff when importing into the US.

The Harmonized Tariff Schedule (HTS) code is a system used to classify traded products for customs purposes. It determines the tariffs and taxes applicable to the product when importing or exporting.

Our HTS Audit is $197. If you hire us to find savings for you, we charge a one-time fee of $499. You only pay if we save you money!

Our No Risk Guarantee ensures that you only pay if we save you money. If we don’t find savings in your tariffs, the audit service is only $197.

No, you do not need a credit card to use our tools. The only time you will be required to make a payment is if you hire us to classify your products.

Savings vary depending on various factors including the type of product and existing tariffs. Our analysis aims to maximize your savings. 80% of our clients have saved money by using our services.

Absolutely. We take data security very seriously and ensure that your information is handled with the utmost care and confidentiality.

Of course you can, just add the quantity to the form. If you have 10 or more ASINs/SKUs please reach out to our customer service team.

Alongside the HTS Audit, we provide a secondary report which includes additional HTS codes and insights on the best countries, materials, and options for further tariff optimization if you’re considering making changes to your product line.

The time taken varies based on the complexity of your product range. Typically, our analysis and recommendations are completed within a few days to a week.

To get started, simply click on the “Claim Your HTS Audit” button and fill out the necessary information. Our team will be in touch to begin the tariff optimization process.

After checkout, you'll be directed to our product submission page, where you can provide all the necessary details about your products.